All Categories

Featured

Table of Contents

Okay, to be fair you're truly "banking with an insurance company" instead than "financial on yourself", but that principle is not as easy to market. It's a little bit like the idea of acquiring a house with money, after that obtaining versus the residence and putting the money to function in another investment.

Some people like to chat regarding the "rate of money", which generally suggests the very same point. That does not suggest there is nothing rewarding to this concept once you get past the advertising.

The whole life insurance sector is afflicted by overly costly insurance, substantial payments, shady sales practices, reduced rates of return, and poorly informed customers and salesmen. If you desire to "Financial institution on Yourself", you're going to have to wade into this industry and in fact acquire whole life insurance policy. There is no substitute.

The guarantees fundamental in this item are vital to its function. You can borrow versus the majority of kinds of cash worth life insurance, but you shouldn't "financial institution" with them. As you get an entire life insurance policy policy to "bank" with, bear in mind that this is an entirely separate section of your financial plan from the life insurance policy section.

Buy a huge fat term life insurance policy policy to do that. As you will certainly see below, your "Infinite Financial" plan truly is not going to accurately provide this important financial feature. Another issue with the reality that IB/BOY/LEAP depends, at its core, on a whole life policy is that it can make getting a policy problematic for most of those interested in doing so.

Priority Banking Visa Infinite Credit Card

Dangerous hobbies such as diving, rock climbing, sky diving, or flying likewise do not blend well with life insurance policy items. The IB/BOY/LEAP advocates (salesmen?) have a workaround for youbuy the plan on somebody else! That may function out great, since the point of the plan is not the fatality advantage, yet keep in mind that getting a policy on small kids is a lot more pricey than it should be since they are generally underwritten at a "common" rate rather than a preferred one.

The majority of plans are structured to do a couple of points. Many frequently, policies are structured to maximize the payment to the agent marketing it. Cynical? Yes. But it's the reality. The commission on a whole life insurance policy plan is 50-110% of the initial year's premium. Often plans are structured to take full advantage of the survivor benefit for the costs paid.

With an IB/BOY/LEAP plan, your objective is not to make best use of the death benefit per dollar in premium paid. Your objective is to make best use of the money worth per dollar in costs paid. The rate of return on the policy is really vital. Among the very best methods to make the most of that factor is to get as much money as possible right into the plan.

The finest way to enhance the price of return of a policy is to have a relatively small "base policy", and after that placed even more cash money into it with "paid-up additions". With more money in the plan, there is more money value left after the costs of the fatality benefit are paid.

An added advantage of a paid-up enhancement over a normal premium is that the commission price is lower (like 3-4% as opposed to 50-110%) on paid-up additions than the base plan. The less you pay in compensation, the greater your price of return. The rate of return on your cash worth is still mosting likely to be adverse for some time, like all cash money worth insurance plan.

It is not interest-free. It might cost as much as 8%. Most insurance policy business only supply "direct recognition" loans. With a straight recognition car loan, if you obtain out $50K, the reward rate applied to the cash money value annually just uses to the $150K left in the plan.

The Banking Concept

With a non-direct recognition loan, the company still pays the very same dividend, whether you have "obtained the cash out" (practically against) the plan or not. Crazy? That recognizes?

The business do not have a resource of magic totally free money, so what they give in one location in the plan should be extracted from an additional location. But if it is drawn from a feature you care less around and take into a function you care extra around, that is an advantage for you.

There is one more essential feature, normally called "clean financings". While it is wonderful to still have actually rewards paid on money you have actually taken out of the plan, you still have to pay passion on that funding. If the returns rate is 4% and the lending is billing 8%, you're not specifically appearing ahead.

With a clean finance, your lending rates of interest coincides as the dividend price on the plan. While you are paying 5% passion on the lending, that interest is totally offset by the 5% reward on the loan. So in that respect, it acts similar to you took out the cash from a bank account.

5%-5% = 0%-0%. Same same. Thus, you are now "banking on yourself." Without all three of these elements, this plan just is not mosting likely to work quite possibly for IB/BOY/LEAP. The biggest problem with IB/BOY/LEAP is the people pushing it. Almost all of them stand to benefit from you acquiring right into this principle.

There are many insurance coverage representatives speaking regarding IB/BOY/LEAP as a function of whole life who are not actually selling policies with the required attributes to do it! The problem is that those who recognize the concept best have a large dispute of interest and generally inflate the benefits of the concept (and the underlying plan).

Infinite Banking Concept Scam

You should compare borrowing versus your policy to withdrawing money from your interest-bearing account. Go back to the beginning. When you have nothing. No deposit. No money in investments. No money in money value life insurance policy. You are encountered with a choice. You can put the money in the financial institution, you can invest it, or you can buy an IB/BOY/LEAP policy.

It expands as the account pays interest. You pay tax obligations on the passion annually. When it comes time to get the boat, you withdraw the cash and get the watercraft. After that you can save some even more cash and put it back in the financial account to begin to gain passion again.

When it comes time to acquire the watercraft, you market the financial investment and pay tax obligations on your long term capital gains. You can save some more money and get some more financial investments.

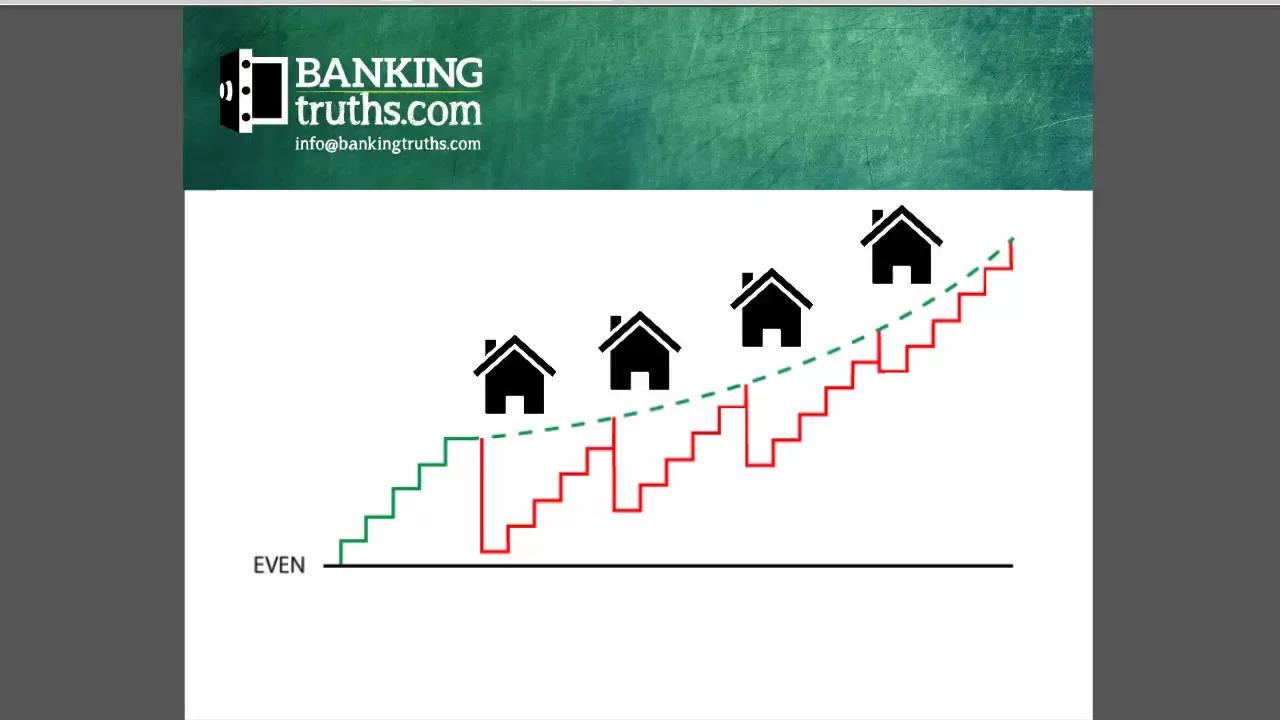

The cash value not utilized to pay for insurance policy and compensations expands throughout the years at the reward rate without tax drag. It begins with adverse returns, however ideally by year 5 or so has actually recovered cost and is expanding at the returns price. When you most likely to purchase the watercraft, you obtain against the plan tax-free.

Cibc Aerogold Visa Infinite Online Banking

As you pay it back, the money you paid back starts growing once again at the dividend price. Those all job pretty in a similar way and you can compare the after-tax rates of return.

They run your credit score and give you a loan. You pay rate of interest on the borrowed money to the financial institution till the lending is paid off. When it is repaid, you have a nearly useless boat and no cash. As you can see, that is not anything like the first three alternatives.

Latest Posts

What Is Infinite Banking Life Insurance

Whole Life Infinite Banking

How Infinite Banking Works